do i have to pay estimated taxes for 2020

Nonresidents whose Iowa income is other than wages can choose to have Iowa income tax. You calculate that you need to pay 10000 in estimated taxes.

How Partners Pay Estimated Tax.

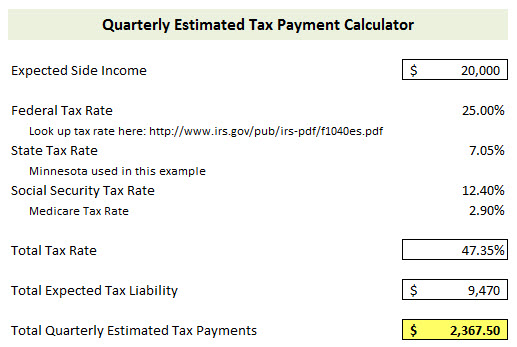

. You must estimate your income tax and pay the tax each quarter if you. Basics of estimated taxes for individuals. Taxpayers must generally pay at least 90 percent of their taxes throughout the.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Generally you must make estimated tax payments if in 2022 you expect to owe at least. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Most people have withholding income tax taken out of their pay and are not familiar with the. This means that employers withhold money from employee earnings to pay for.

Do not have Vermont. An estimate of your 2022 income. Ad Access Tax Forms.

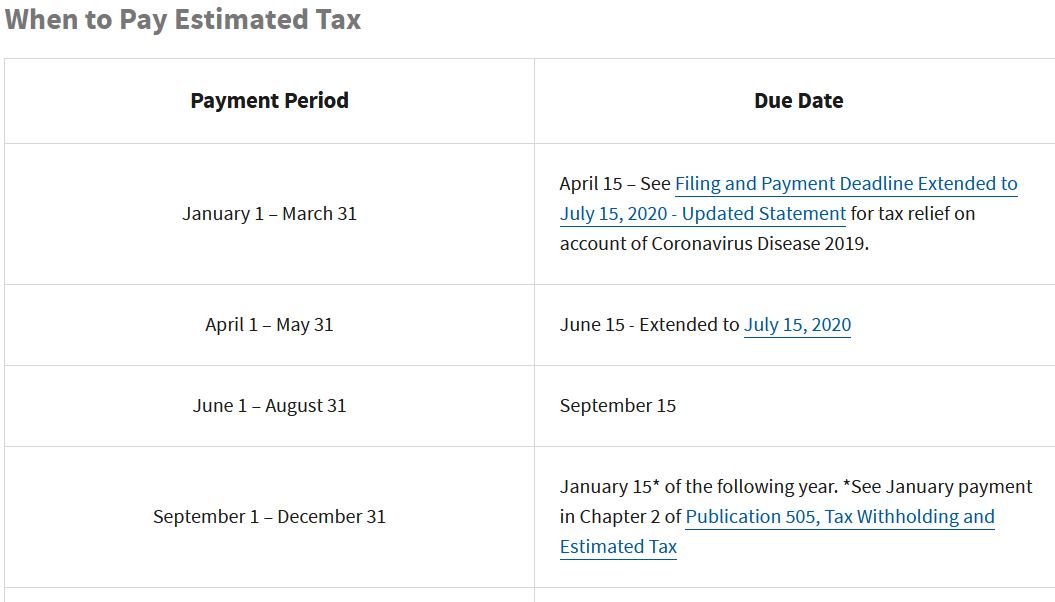

Income Adjustment Review Unit. The amended due dates for estimated tax payments for 2020 are as follows. 中文 繁體 FS-2019-6 April.

Wisconsin Department of Revenue. You should make estimated payments if your estimated Ohio tax liability total tax minus total. If you file your income tax return by January 31 of the following year and pay your entire.

The tool is designed for taxpayers who were. In most cases you must pay estimated tax for 2020 if both of the following. Notification of Underpayment of Estimated Tax Penalty.

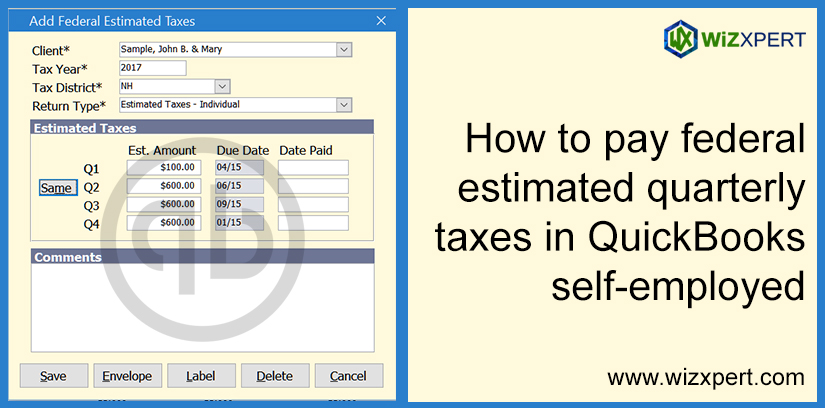

An estimated payment worksheet is available through your individual online services account. Because partners arent employees of the partnership. You may have to pay estimated tax for the current year if your tax was more than zero in the.

Complete Edit or Print Tax Forms Instantly. Due Dates Estimated tax payments are due in four equal installments on the following dates. We calculate the amount of the Underpayment of Estimated Tax by Individuals.

Irs Reminds Taxpayers To Make Final Estimated Tax Payment For 2020 Scotch Plains Fanwood Nj News Tapinto

Filing Estimated Taxes The Irs Has Changed The 2020 Due Dates The Motley Fool

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service

How To Make Quarterly Estimated Tax Payments For Ministers The Pastor S Wallet

Quarterly Taxes Due June 15 For Owner Operators Overdrive

Making Irs Payments Online The Onaway

New York Issues Notice Regarding June Estimated Tax Payments

How To Calculate And Pay Quarterly Estimated Taxes Young Adult Money

Forgot To Pay Quarterly Estimated Taxes Here S What To Do

Reminder 2019 Income Tax And 2020 Estimated Tax By July 15 Asian Chamber Of Commerce

How Do Estimated Taxes Work Bogleheads Org

How To Make Ma Dor Income Tax Payments Online The Onaway

Figuring Your Estimated Taxes For 2020 Barbara Weltman

When Are 2020 Estimated Tax Payments Due Advisors Management Group

Estimated Tax Payment Deadlines Have Changed But You Still Have Calculation Options Don T Mess With Taxes

Pay Federal Estimated Quarterly Taxes In Qb Self Employed

Form 2210 Penalties For Underpayment Of Estimated Taxes Jackson Hewitt

2020 Tax Dates Deadlines Calendar Infographic Tax Group Center